KKS Law Office

- Court does not sit in appeal over Arbitration Tribunal’s interpretation of contract while dealing with an application u/S.34, Arbitration Act: SC

- No parole can be granted for maintaining conjugal relationships with live-in partner: DHC

- Three months’ time period prescribed for conducting preliminary assessment under JJ Act is not mandatory: SC

Complexities surrounding transfer pricing regulations are wide and it is advisable for companies to mitigate the regulatory concerns before they arise.

Alternative dispute resolution (ADR) has grown over a period of time and has become an important means in the dispute resolution process.

In addition to representing our clients in challenging various anti-dumping and countervailing duties before the authorities, we also provide entire array of legal services

Our capacity building group provides a unique resource for governments and non-governments seeking to form a best in class regulatory institution.

We advise on full range of competition matters, including cartel enforcement, abuse of dominant position, merger control and competition audit and compliance.

We assist our clients in re-organization and reconstruction of companies, debt restructuring, and refinancing to formal insolvency procedures such as administration

assistance to foreign companies for routing entry strategies for investment in India and assisting them through Government regulations and procedures

The Team KK understands how intellectual property (“IP”) assets can best be created , value thereto determined and rights therein protected and used/ acquired/ supplemented

Team KK represents clients in all type of Civil and Criminal matters at pan India level, in all courts including Supreme Court of India, High Courts and District Courts.

We, at KK Sharma Law Offices, take pride in serving clients ranging from investment banks, companies and large corporate groups in merger and acquisition deals.

Every new business needs a solid legal foundation. We appreciate that when time and resources are scarce, legal concerns often take a back seat. However, getting the legal basics

Mergers, acquisitions and other business transactions present excellent opportunities for companies to improve tax efficiency. During such transactions tax risks

Due Diligence is essential to any growing company in today’s challenging business environment to understand and evaluate a prospective acquisition, buyer or partner.

Team KK assists enterprises in minimising their global tax burden and reduce exposure to unfavourable audit assessments through in-depth tax planning.

[twitter_profile screen_name=”KkSharmaIRS” height=”295″]

Member, Advisory Council

Member, Advisory Council

Member, Advisory Council

Secretary, Advisory Council

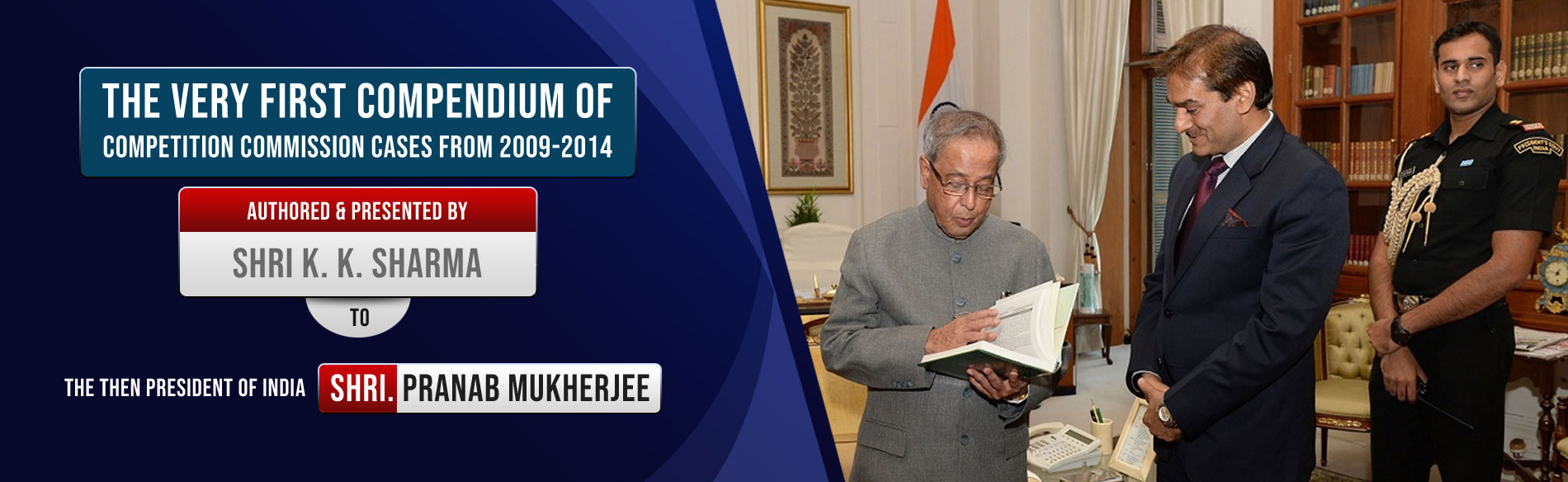

Book your exclusive appointment with KK, The Architect of Indian Competition Law and one of the top lawyers in whole world

[email-posts-subscribers namefield=”YES” desc=”” group=”Newsletter”]

Volume 10 Issue 5

Volume 10 Issue 4

Volume 10 Issue 3

Volume 10 Issue 2

Volume 10 Issue 1

Volume 9 Issue 12

Volume 9 Issue 11

Volume 9 Issue 10

Volume 9 Issue 6

Volume 9 Issue 5

Volume 9 Issue 4

Volume 9 Issue 3

Volume 9 Issue 2

Volume 9 Issue 1

Search

Search

Latest News

Latest News